best tax saving strategies for high income earners

Maxing out contributions to a pre-tax retirement account can help support future-forward goals. A great tax saving strategy for self-employed high income earners is to record and track all of your business expenses.

Tax Reduction Strategies For High Income Individuals In 2021 Youtube

Use Roth Conversions Wisely and Regularly.

. In fact Bonsai Tax can help. Lets start with an overview of tax rules for. Overview of Tax Rules for High-Income Earners.

With the new wage base at 160200 high-income earners will pay a 62 Social Security tax on that amount if they are employed or 124 if they are self-employed. Dont discount the wealth-generating potential and flexibility an HSA can afford. If you earn a high income here are tax saving strategies that will help you keep more of your hard earned cash.

1441 Broadway 3rd Floor New York NY 10018. That is why we suggest that you read our Ultimate Guide for the best tips to find the right financial advisor for you. According to the ATO youre classified as a higher income earner if you earn over 180000 a year.

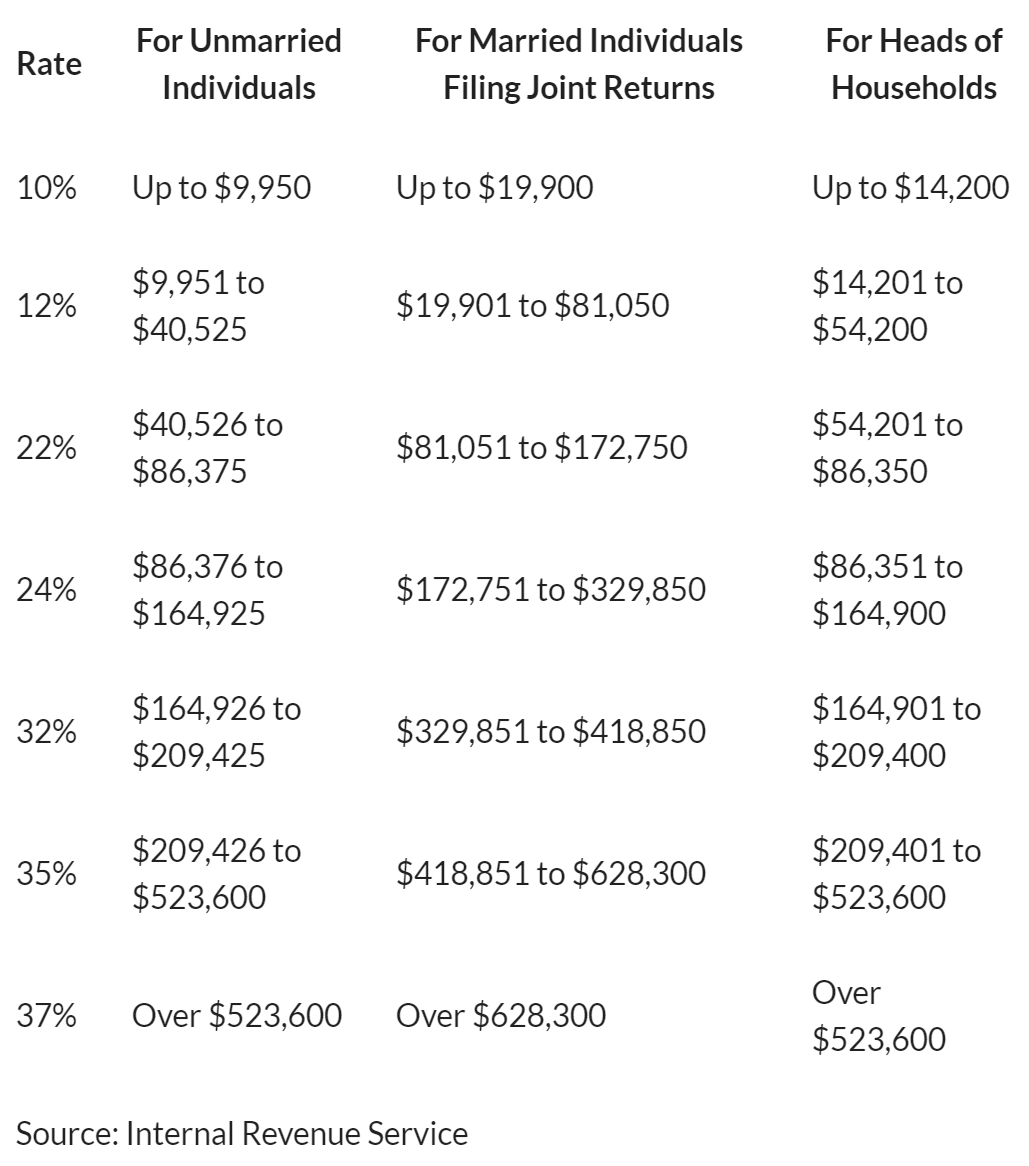

Buying assets in your partners name. An overview of the tax rules for high-income earners. For high earners minimizing income taxes now and into retirement can be a challenge.

Another one of the best tax reduction strategies for high-income earners is to contribute to a retirement account. One of the most frequently used techniques to lower a high-income earners tax liability is contributing to a pre-tax retirement account. As a high-income earner you may feel comfortable about your ability to cover out-of-pocket medical costs.

Because she stays at home she. According to the IRS the limit in. Tax Planning Strategies for High-income Earners.

High-income earners make 170050 per year. Converting some of your retirement account funds to a Roth is one of the most counter-intuitive tax strategies for high-income. Our tax receipt scanner app will scan.

Tax strategies exist that can help ease these tax burdens while offering greater. In this post were breaking down five tax-savings strategies that can help you keep more money in. We will begin by looking at the tax laws applicable to high-income earners.

By reducing taxable income ones tax rate goes down. For this strategy to be effective your partner must have a lower marginal tax rate than you do. So the money was distributed to Mary.

In 2021 the employee pre-tax contribution limit. The more you make the more taxes play a role in financial decision-making. Mon - Fri.

Here are some of our favorite income tax reduction strategies for high earners. Because his income is so high any extra income will be taxed at the highest rate currently at 465. Max Out Your Retirement Account.

This is one of. Family Income Splitting and Family Trusts. In fact if youre earning in excess of 180000 youre taxed at 47 for the privilege.

In this way the net income from the.

5 Outstanding Tax Strategies For High Income Earners

Tax Reduction Strategies For High Income Earners 2022

Episode 67 Investing For High Income Earners Wealthability

Tax Saving Strategies For High Income Earners Smartasset

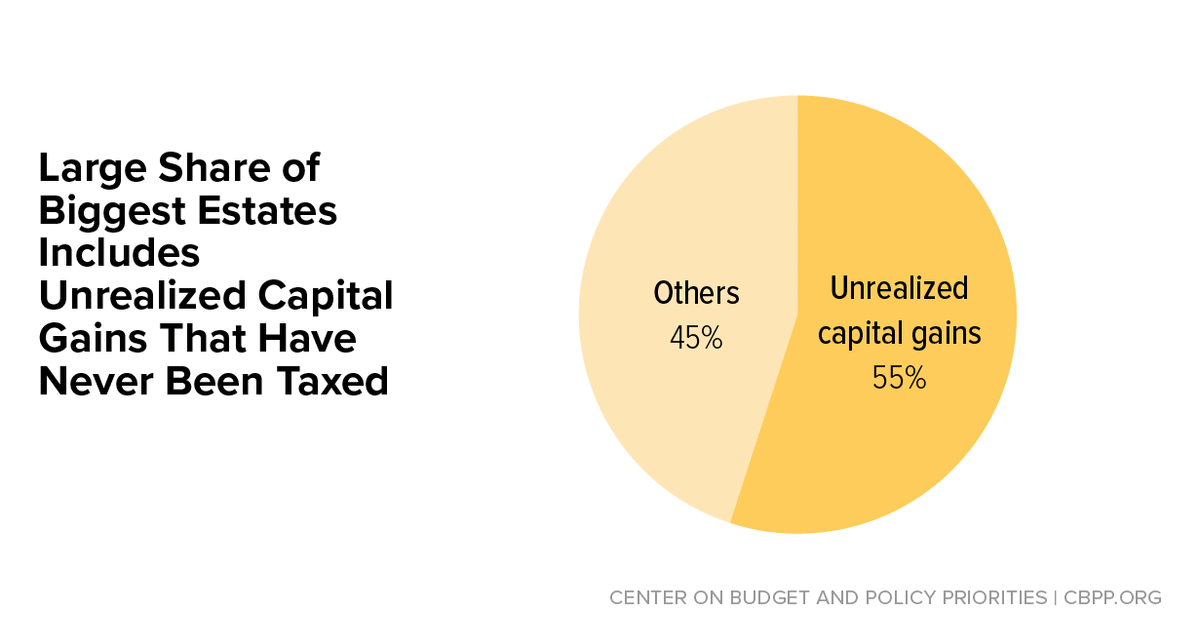

Substantial Income Of Wealthy Households Escapes Annual Taxation Or Enjoys Special Tax Breaks Center On Budget And Policy Priorities

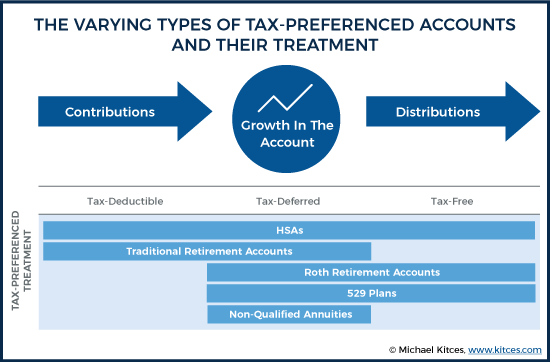

The Hierarchy Of Tax Preferenced Savings Vehicles

Tax Strategies For High Income Earners Taxry

The 4 Tax Strategies For High Income Earners You Should Bookmark

Tax Saving Strategies For High Income Earners Smartasset

High Income Earners Need Specialized Advice Investment Executive

5 Tax Strategies For High Income Earners Pillarwm

Tax Reduction Strategies For High Income Earners Pure Financial

Tax Strategies For High Income Earners Taxry

Tax Deductions For High Income Earners To Claim 2022

:max_bytes(150000):strip_icc()/Term-Definitions_backdoor-roth-ira-ef8e60bcd8a84c80ae9bc8d4f05bd04d.png)

Backdoor Roth Ira Advantages And Tax Implications Explained

Tax Strategies For High Income Earners First Financial Consulting

Chiropractic And How To Reduce Taxes For High Income Earners

Tax Strategies For High Income Earners Wiser Wealth Management

5 Tax Deductions For High Earners Plus A Tax Hack The Physician Philosopher